Appeals to consider invoice for calculating GST on tariff of hotels, reduction in GST rates on almond kernels

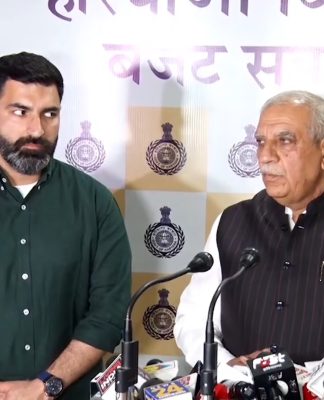

SRINAGAR, MAY 25: A delegation of Confederation of Indian Industry (CII) on Friday called on Minister for Finance, Labour and Employment Syed Mohammad Altaf Bukhari.

The meeting was attended by Principal Secretary Finance Naveen Kumar Chaudhary, Chairman J&K Bank Parveez Ahmad, Chairman CII Saddam Zaroo, Post Chairman Rahul Sahai and Raju Choudhary, Vice Chairman Rajesh Sharma, Zonal Head Srinagar Khurshid Dar and other senior officers of the government and CII.

The representatives of CII apprised the minister about various issues faced by the industries in the state and sought the intervention of the minister in resolving their issues.

The delegation urged the government to reduce the GST rate on Almond kernels from 12 percent to 5 percent. They said after the implementation of GST, all other similar nuts category and dried fruits like raisins, cashew Kernels and walnuts were initially taxed at 12 percent but later on taxed at 5 percent except almond kernels.

The delegation of CII further appealed the minister to consider the invoice value for calculating the GST rate in hotels and also requested that the GST be taxed at not more than 12 percent stating that the current rate is 28 percent. They said the lack of clarity around a key term for calculating the GST rates for hotels, is spelling trouble for consumers.

While stating that the government has said that hotels with ‘declared tariffs’ of Rs 7500 and above will charge 28 % GST, CII representatives said that the term ‘declared tariff’ is unclear as hotels could declare new seasonal tariffs several times a year and rates may vary with each season.

They appealed the government to provide clarity and consider invoice value for calculating GST rates in hotel.

The delegation also requested for issuance of clarification for SRO 63 issued by finance department in February this year for extension of benefit to service sector industries falling under thrust industry as per State Industrial Policy in addition to manufacturing industry. They said the step will encourage young entrepreneurs to start similar investing in the said industry.

The delegation also appealed the government to refund the fiscal incentives under GST on monthly basis instead of quarterly basis to provide relief to the industrial sector of the state.

The meeting discussed threadbare the issues raised by the representatives of CII. Minister said the government is committed to take every positive step to help the industry sector to grow in the state.

He assured the visiting delegation that government will take every possible step to ensure favorable environment for the industries to grow in the state. He said the government has already directed to refund the GST of three quarters at earliest. He said the refund will be made on monthly basis soon after the system is put in place.